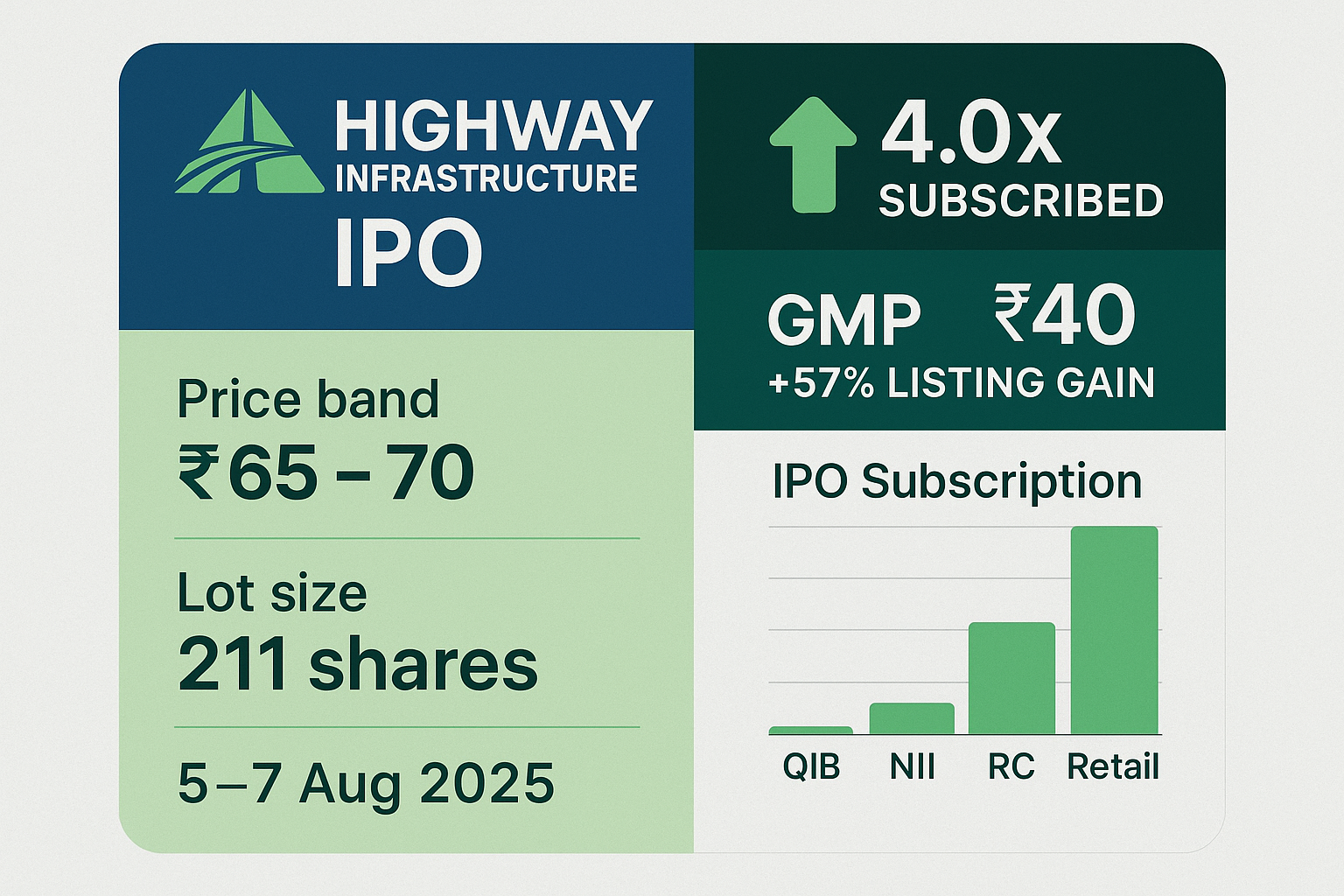

IPO Dates: 05–07 August 2025

Price Band: ₹65–₹70 per share

Lot Size: 211 shares (₹14,770 min investment)

IPO Snapshot

- Issue Size: ₹130 Cr (Fresh ₹97.52 Cr + OFS ₹32.48 Cr) :contentReference[oaicite:3]{index=3}

- Registrar & Lead Manager: Bigshare Services & Pantomath Capital Advisors :contentReference[oaicite:4]{index=4}

- Investor Allocation: Retail ≥40%, NII ≥30%, QIB ≤30% :contentReference[oaicite:5]{index=5}

Day‑1 Subscription & GMP

Within the first 40 minutes, the IPO was fully subscribed and exceeded 3.7× subscriptions by mid‑morning. Retail bids were over 5×, NII ~3.3×; QIB participation remained limited initially :contentReference[oaicite:6]{index=6}.

Grey Market Premium (GMP) stood around ₹40–₹41, suggesting a possible listing price near ₹110 — nearly 57% above the upper price band :contentReference[oaicite:7]{index=7}.

About the Company

Founded in 1995, Highway Infrastructure Ltd operates toll operations across 11 states + 1 UT, EPC projects including roads, bridges, irrigation, deliveries completed in key Madhya Pradesh corridors like Indore‑Ratlam and Khandwa. EPC and real estate businesses supplement its core toll revenue stream :contentReference[oaicite:8]{index=8}.

Financial Performance (FY25)

- Revenue: ₹495–504 Cr (–13–13.6% YoY) vs FY24, but PAT rose ~4.5% to ₹22.4 Cr :contentReference[oaicite:9]{index=9}.

- Order Book: ₹666 Cr (EPC ₹606 Cr + Toll ₹60 Cr) as of May 2025 :contentReference[oaicite:10]{index=10}.

- Return Ratios: ROE ~19%, ROCE ~16.6%, PAT Margin ~4.4%, EBITDA ~6.3%, Debt/Equity ~0.6, P/B ~3.4 ×, post‑IPO market cap ~₹502 Cr (upper band) :contentReference[oaicite:11]{index=11}.

Key Strengths & Risks

- Strengths: Niche toll operations with ANPR/RFID systems, strong orderbook, steady PAT growth, diversified EPC + toll revenue base :contentReference[oaicite:12]{index=12}.

- Risks: Revenue decline in FY25, margin pressure from raw material volatility, modest scale relative to big peers, valuation at upper‑end P/E ~22.4× post‑IPO :contentReference[oaicite:13]{index=13}.

Verdict: Apply or Wait?

With strong initial demand, high GMP, and a balanced mix of toll + EPC infrastructure, Highway Infrastructure presents a compelling short‑term listing play. Analysts at Swastika Investmart and Fynocrat suggest a **“Subscribe for Listing Gain & Long-Term Hold”** strategy, though caution around valuations and scale remains warranted :contentReference[oaicite:14]{index=14}.

Summary:

- Issue size: ₹130 Cr, price band ₹65–70

- Day‑1 response: ~3.7× overall, retail >5×

- GMP: ₹40–41 → listing expected ~₹110 (~57% upside)

- Financials: revenue down ~13%, PAT up ~4.5%, strong orderbook

- Valuation: P/E post‑IPO ~22×, P/B ~3.4x, RoE ~19%

FAQ

Q: What is GMP and why ₹40?

A: Grey Market Premium is the pre-listing estimate of profit — ₹40 over ₹70 implies listing expectation near ₹110 (~57% upside) :contentReference[oaicite:15]{index=15}.

Q: What is the minimum investment?

A: One lot of 211 shares at ₹65 = ₹13,715 minimum; retail max ~13 lots (₹192k), sNII ~₹2.06L, bNII ~₹10L+ :contentReference[oaicite:16]{index=16}.

🔖 Tags:

#HighwayInfrastructureIPO #HILIPO #InfrastructureIPO #IPOSubscription #GreyMarketPremium #TollEPC #MidCapIPO #IPO2025