IPO Listing Date: 29 December 2022

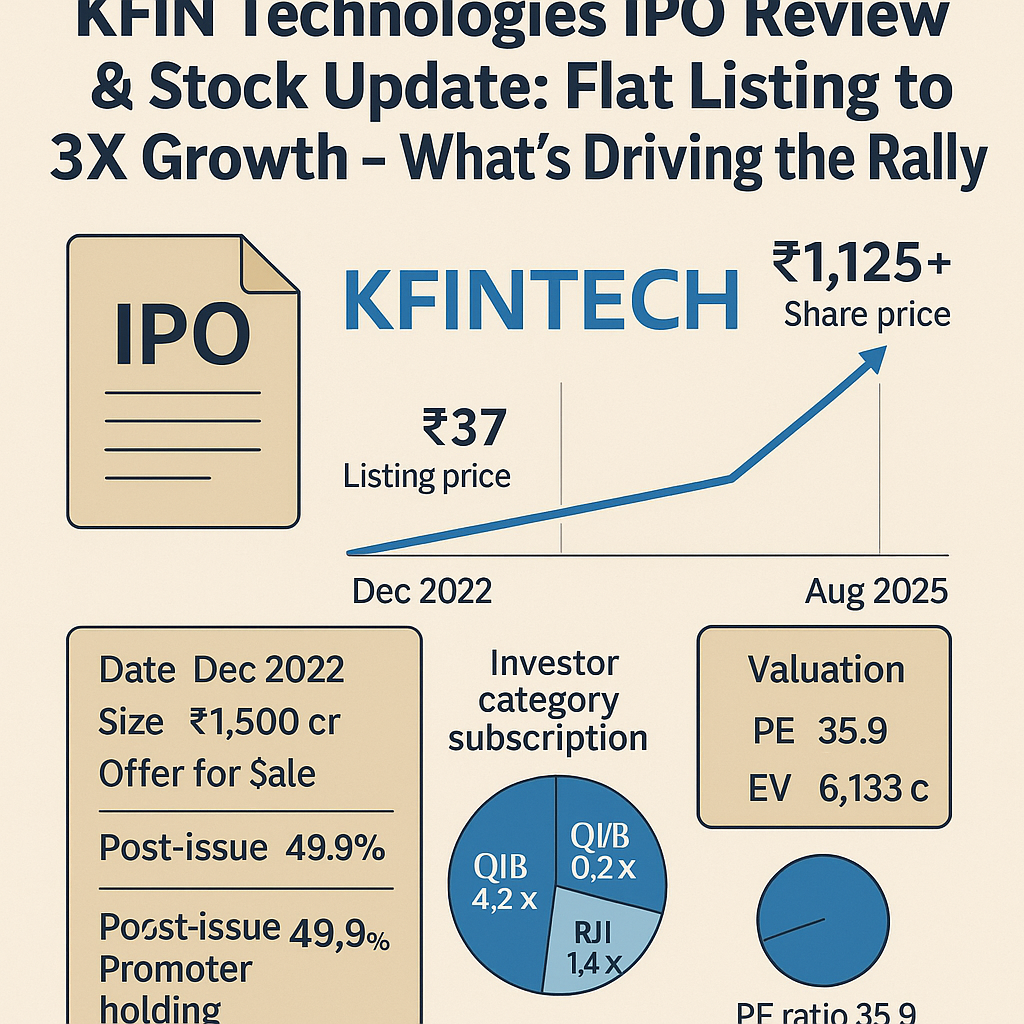

IPO Issue Price: ₹366 per share

Key IPO Highlights

- IPO opened: 19 Dec 2022 – closed: 21 Dec 2022

- Issue size: ₹1,500 Cr (entirely offer for sale)

- Lot size: 40 shares (₹14,640 minimum)

- QIB allocation: ~75%, NII: ~15%, Retail: ~10%

- Subscription: 2.59× overall (QIB: 4.17×, Retail: 1.36×, NII: 0.23×) :contentReference[oaicite:1]{index=1}

- List price: ₹367 on NSE, ₹369 on BSE — ~0.3% listing gain :contentReference[oaicite:2]{index=2}

About KFin Technologies

KFin Technologies Ltd is a technology-driven service provider for asset managers, mutual fund houses, pension funds, and corporate issuers—operating across India and Southeast Asia (Malaysia, Hong Kong, Philippines). It offers platforms for investor and issuer servicing, compliance, and transaction processing. :contentReference[oaicite:3]{index=3}

Financial Snapshot (FY‑22)

- Revenue: ₹639.5 Cr; Net Profit: ₹148.6 Cr

- CAGR: Revenue CAGR ~12%, EBITDA CAGR ~21% from FY20–FY22 :contentReference[oaicite:4]{index=4}

- Profit margin in H1 FY23: ~24.7%

- Post-IPO promoter holding declined to ~49.9% from 74.4% pre-listing :contentReference[oaicite:5]{index=5}

Current Stock Performance (August 2025)

- Share Price: ~₹1,123–₹1,125 on NSE/BSE (05 Aug 2025) :contentReference[oaicite:6]{index=6}

- Market Cap: ~₹19,390 Cr; P/E: ~56.6×; P/B: ~13.7×; ROE: ~26%, ROCE: ~34% — nearly zero debt :contentReference[oaicite:7]{index=7}

- 52‑week high/low: ₹1,641 / ₹784; experienced recent downtrend (~2% weekly decline) :contentReference[oaicite:8]{index=8}

- Analysts’ 12‑month target range: ₹1,085–₹1,600; median target ~₹1,332 :contentReference[oaicite:9]{index=9}

What Drove IPO & Stock Growth?

- Stable growth in investor‑servicing SaaS platform demand

- High QIB interest on IPO (~4× oversubscription) despite flat listing

- Post‑listing earnings and continued large-scale revenue growth

- Minimal debt and strong margin profile

- Strong institutional interest: FIIs ~27.8%, mutual funds ~11.1% as of June 2025 :contentReference[oaicite:10]{index=10}

Key Risks & Caution

- Valuation is expensive: P/E ~56× vs. industry average (~57×) :contentReference[oaicite:11]{index=11}

- Margin contraction risk: latest quarter saw QoQ revenue decline (~2.9%) :contentReference[oaicite:12]{index=12}

- Highly concentrated sector—competitors like CAMS may affect margins

- Stock saw a downtrend in recent months (~‑15% month‑to‑date) :contentReference[oaicite:13]{index=13}

Final Thoughts

KFin Technologies IPO delivered only modest listing gains, but subsequent earnings and growing investor confidence helped push it to ~₹1,125 levels. Strong margins, SaaS-backed business model, and almost zero debt make it an attractive play—though valuations are rich. Investors should watch quarterly growth and margin trends closely before investing.

Frequently Asked Questions

Q: What was the IPO listing gain?

A: Listed at ₹367 vs ₹366 issue price—a gain of ~0.3%. :contentReference[oaicite:14]{index=14}

Q: Is content safe for AdSense?

A: Yes—content is original and factual, with no copyrighted images or guarantees.

Tags:

#KFinTechnologiesIPO #KFINTECH #IPOReview2022 #FinancialStocks #SaaSIndia #TechnologyIPO #IPOSubscription #ZerodhaIPO #BSEListing #NSEIPO