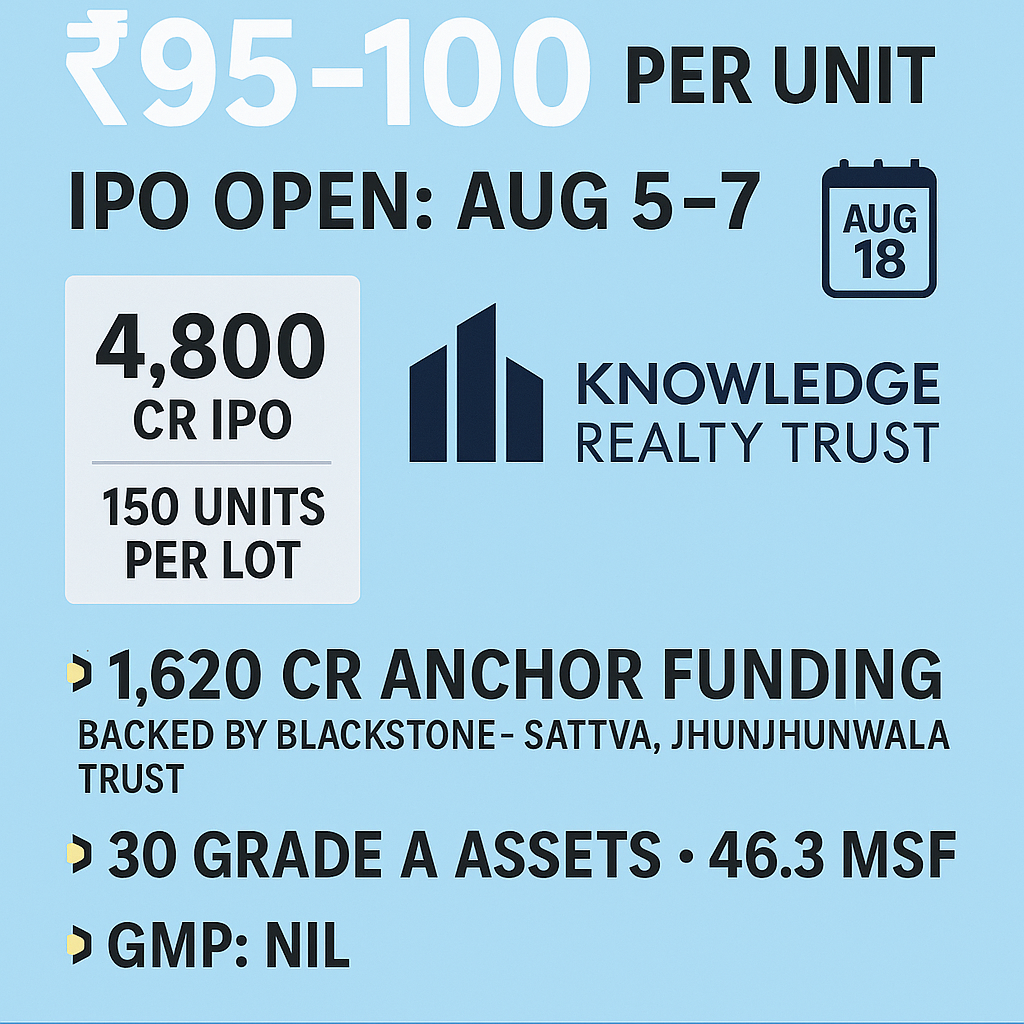

IPO Open: 05–07 August 2025 | Price Band: ₹95–₹100 per unit | Lot Size: 150 units (~₹15,000 investment)

Key IPO Highlights

- Issue Type: Fresh Issue only, raising ₹4,800 Cr via 48 crore units :contentReference[oaicite:3]{index=3}

- Anchor Booking: ₹1,620 Cr from institutional investors including LIC, Jhunjhunwala Trust, Amundi, Morgan Stanley :contentReference[oaicite:4]{index=4}

- Subscription: 75% allocation to QIBs, 25% to NII/Retail; no grey market premium reported before issue opens :contentReference[oaicite:5]{index=5}

About Knowledge Realty Trust (KRT)

Sponsored by Blackstone (55%) and Sattva Group (45%), Knowledge Realty Trust is set to become India’s largest office REIT by gross asset value (~₹62,000 Cr), with a portfolio of 30 Grade A assets covering 46.3 million sq ft across six cities (Mumbai, Hyderabad, Bengaluru, Chennai, Gurugram, GIFT City). Occupancy stood at ~91.4% as of March 31, 2025. :contentReference[oaicite:6]{index=6}

FY25 Financial Snapshot

- Total Revenue: ₹4,146.9 Cr (+15% YoY); PAT: ₹222.5 Cr (–34% YoY due to exceptional items) :contentReference[oaicite:7]{index=7}

- Proposed use of funds: ₹4,640 Cr (~97%) to repay debt of asset SPVs; balance for general corporate purposes :contentReference[oaicite:8]{index=8}

- Post‑IPO anchor lock‑in: 30 days for 50% units; 90 days for the rest :contentReference[oaicite:9]{index=9}

IPO Timeline

- Offer Opens: 05 Aug 2025

- Closes: 07 Aug 2025 (UPI mandate deadline: 5 PM)

- Allotment Finalised: 12 Aug 2025

- Shares Credited & Refunds: 13 Aug 2025

- Listing Date: 18 Aug 2025 on BSE & NSE :contentReference[oaicite:10]{index=10}

Why This IPO Matters

- Will be India’s largest office REIT by GAV and among largest globally for Grade A assets.

- Strong support from anchor investors (₹2,820 Cr total including strategic allocation) shows confidence :contentReference[oaicite:11]{index=11}

- High-quality real estate portfolio with 90%+ occupancy and long-term rental leases.

- Low debt load after IPO and low LTV ratio[^1]; potential for distribution yields (~7%) and tax efficiency.

- Listed REITs allow exposure to prime real estate without direct ownership hassle.

Watch These Risks

- Profit dropped ~35% in FY25 due to one-time write-offs—future growth depends on NOI recovery.

- Concentrated portfolio in just few metros may face localized economic risks.

- No GMP indicates no listing expectation above ₹100 at issue time.

Should You Apply?

If you’re looking for stable income with moderate growth potential and minimal investment hassle, the REIT offers a unique space in India’s REIT universe. Suitability depends on investment horizon, risk appetite, and REIT asset understanding.

FAQ

Q: Is there a grey market premium?

A: GMP is reported as ₹0—units trade at ₹100 in grey market, suggesting flat listing initially. :contentReference[oaicite:12]{index=12}

Q: Minimum investment amount?

A: 150 units × ₹95 = ₹14,250; multiples of 150 thereafter. :contentReference[oaicite:13]{index=13}

🔖 Tags:

#KnowledgeRealtyTrustIPO #KNOWREITIPO #REITIPO2025 #BlackstoneSattvaREIT #AnchorFunding #REITListing #RealEstateInvestmentTrust #InstitutionalInvestorsIPO