Shakti Pumps: Why Stock Is Falling Despite Strong Orders? Google Trends Reveal the Truth

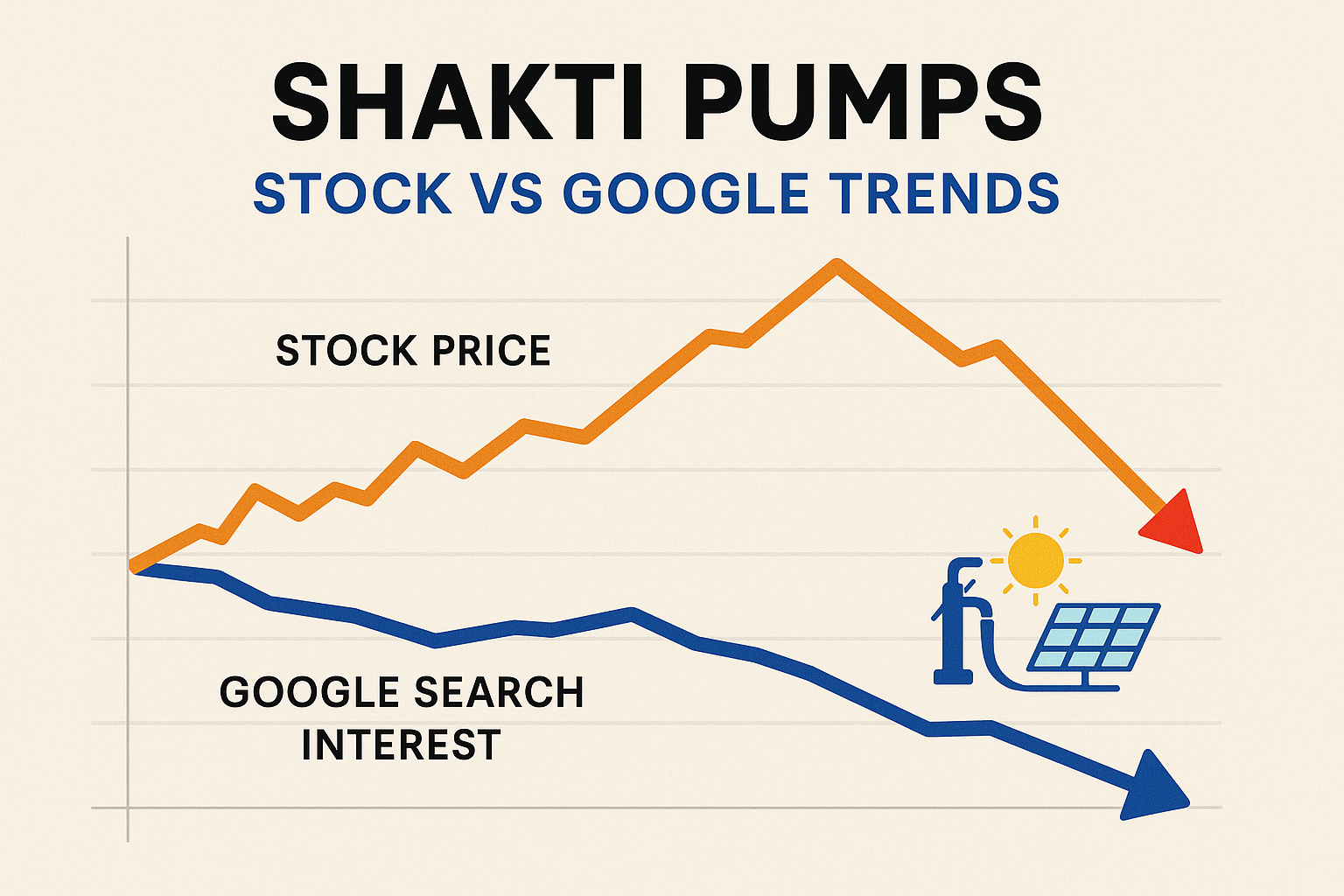

Shakti Pumps India Ltd (SHAKTIPUMP) is under the spotlight again—but this time not for soaring gains. Despite recent government orders and good Q1 FY26 results, the stock has dropped over 8% and Google search interest has declined by over 50% in the past month.

Stock Price vs Google Trends

- Stock Price: ₹865 (as of August 4, 2025)

- YoY Profit Growth: 4.5% in Q1 FY26 (₹96.8 crore)

- Search Volume: Dropped by ~55% this month (Source: Google Trends)

What’s Behind the Fall?

Despite an ₹114.58 crore order from MEDA under the PM-KUSUM Yojana for solar pumps, investors reacted negatively. Market experts say:

- Valuation is high (P/E ~26x)

- Modest revenue growth (~9.7% YoY)

- Technical indicators show bearish signals

Financial Snapshot

| Metric | Value |

|---|---|

| Revenue (Q1 FY26) | ₹250.3 Cr |

| Net Profit | ₹96.8 Cr |

| Debt-to-Equity | 0.2 |

| ROE | 29% |

Upcoming Catalysts

- Government schemes like PM-KUSUM may push demand for solar pumps

- New export markets in South America and Africa

- Expansion in rooftop solar and EV segment

Expert Opinion

“Shakti Pumps has strong fundamentals, but the stock may be overheated. Wait for healthy correction before entry.” — Market Analyst

Final Thoughts

Though Shakti Pumps continues to win orders and deliver profits, investor caution is visible. Monitor trends, volumes, and government announcements closely before investing.

Have you invested in Shakti Pumps? Share your views in the comments below!